€15 million

or 2% of annual turnover - maximum penalties under DORA

$5.85 million

is the average cost of data breach in the financial sector

60% of financial institutions

Experienced cyber attacks in 2021 (ECB Banking Supervision Report, 2022)

Securing Financial Data Under DORA

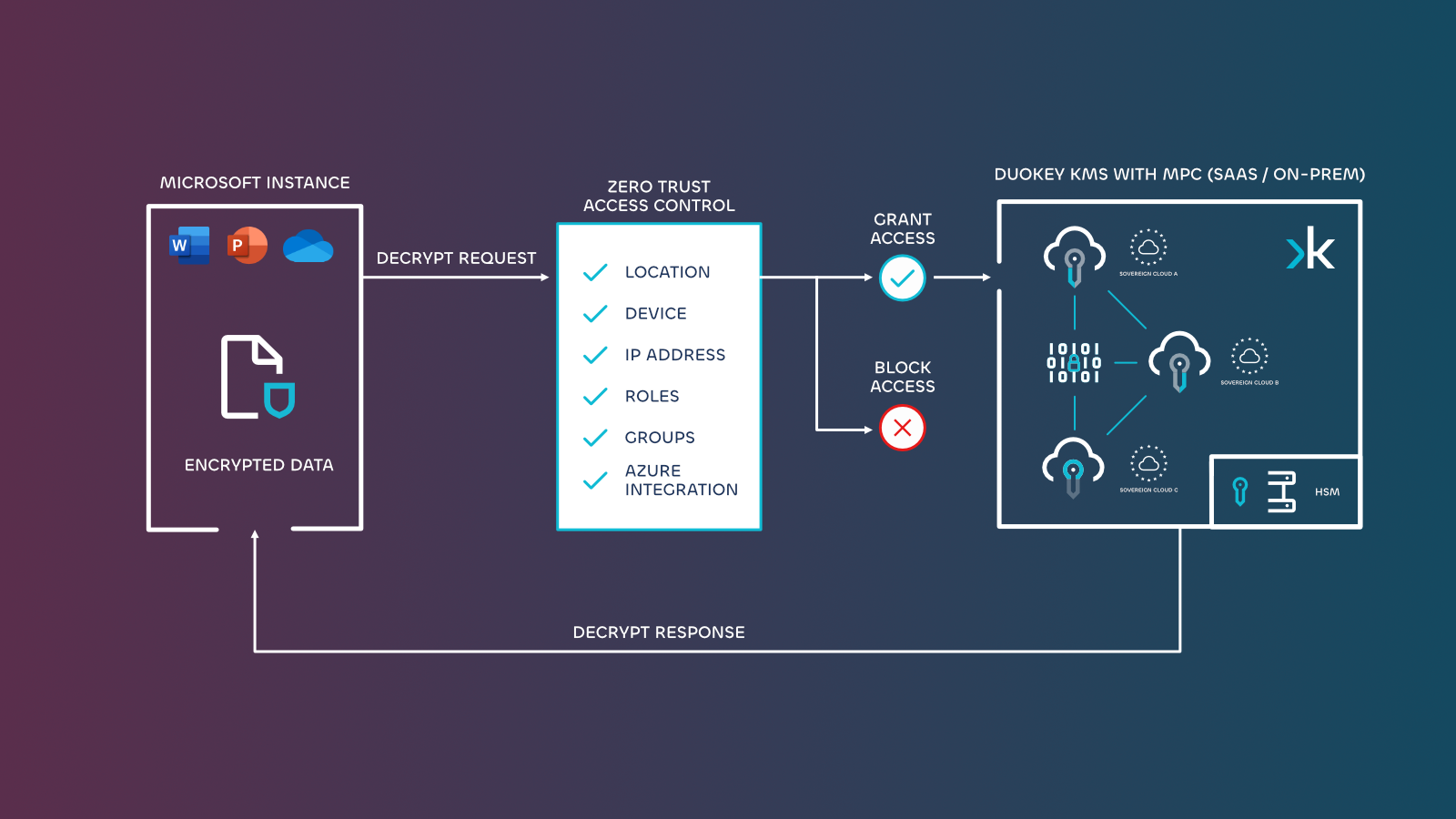

The Digital Operational Resilience Act (DORA - EU Regulation 2022/2554) and its delegated act introduce stringent requirements for financial institutions regarding their ICT security. A key focus is on encryption and secure key management, particularly in cloud environments where traditional approaches may fall short (Article 9 - 13).

Financial institutions must now implement robust encryption solutions with secure cryptographic key management that ensure both data protection and operational resilience.

Financial Data Encryption for DORA

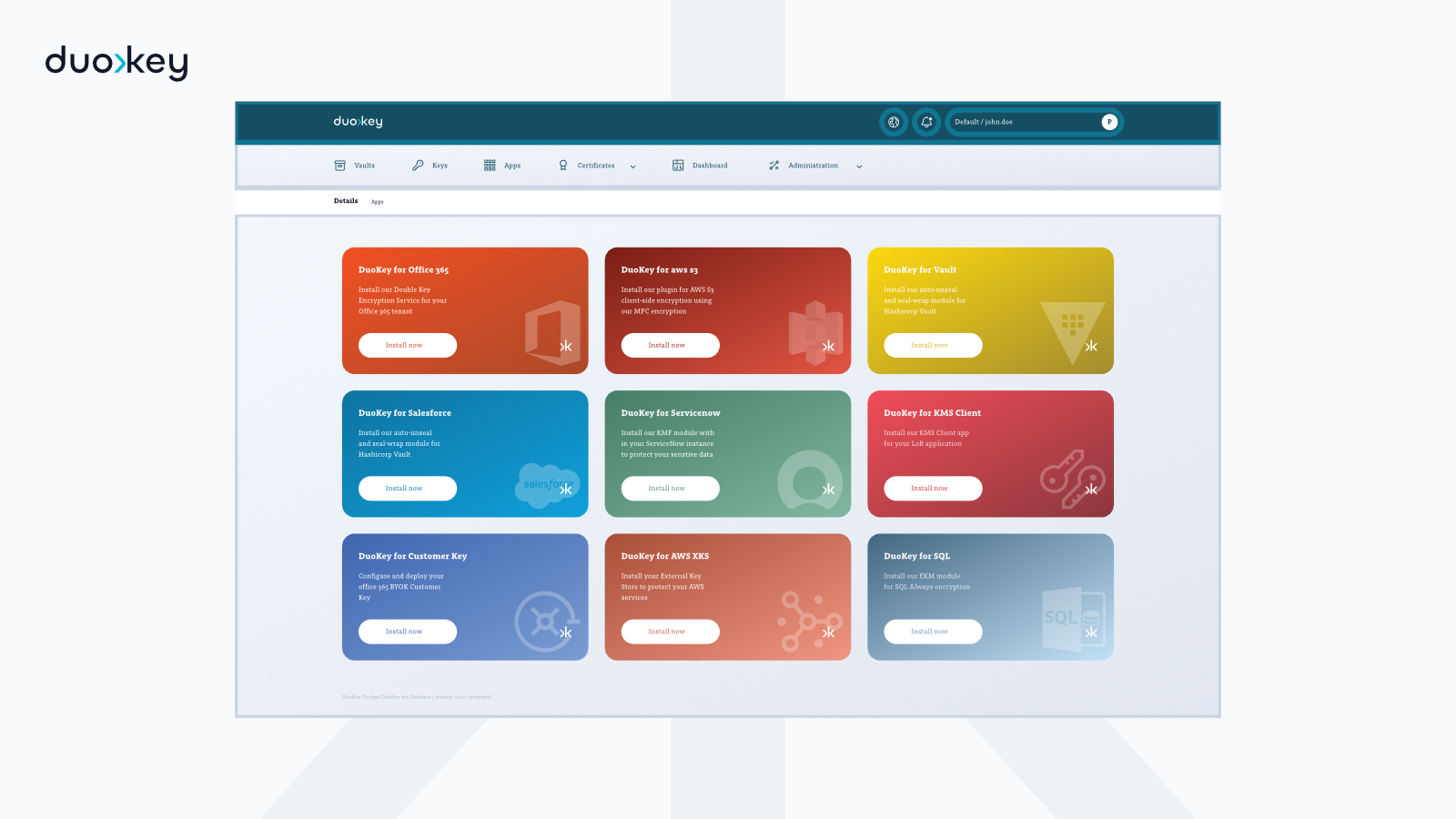

DuoKey provides advanced encryption solutions with a zero-trust and a cloud independent approach for financial data encryption on major cloud providers, including:

Microsoft 365 & Azure Cloud, AWS, Vault, Google Cloud, Salesforce and more...

Strengthen Your Operational Resilience

DuoKey helps financial and banking organisations secure their financial data for DORA compliance with advanced data encryption solutions.

Advanced financial data encryption enables financial institutions to confidently leverage cloud capabilities, while minimising compliance risks and strengthening operational resilience.